We strive to create superior levels of performance for the benefit of all our stakeholders by following a framework of good

corporate governance.

Our corporate governance practices are sound, meeting all applicable rules and regulations, such as the King IV™ Report and the

Listings Requirements. We are aware of the Public Investment Corporation’s proxy voting policy and Code for Responsible

Investing in South Africa 2011, and have implemented measures to comply with these requirements as far as possible.

The King IV™ Principles are the foundation of our corporate governance framework, and we remain committed to supporting the

leading practices set out in the Code.

In addition to this, the ESG Committee highlights our commitment to supporting all aspects of ESG – not least because good

governance is key in ensuring that we continue operating as a sustainable business.

The Board operates in terms of a formally approved Mandate and

Terms of Reference which set out its role and responsibilities, the

main elements of which are:

• the Chairman of the Board must be an Independent Non-Executive Director;

•a formal orientation programme for new directors must be followed;

• specific policies, in line with King IV™, must exist with regard to

conflicts of interest and the maintenance of a register of

directors’ interests;

• the Board must conduct an annual self-evaluation;

• directors must have access to staff, records and outside

professional advice where necessary;

• succession planning for executive management must be in place

and must be updated regularly;

• strategic plans and an approvals framework must be in place and

reviewed regularly;

• policies to ensure the integrity of internal controls and risk

management must be in place; and

• social transformation, ethics, safety, health, human capital, and

environmental management policies and practices must be

monitored and reported on regularly.

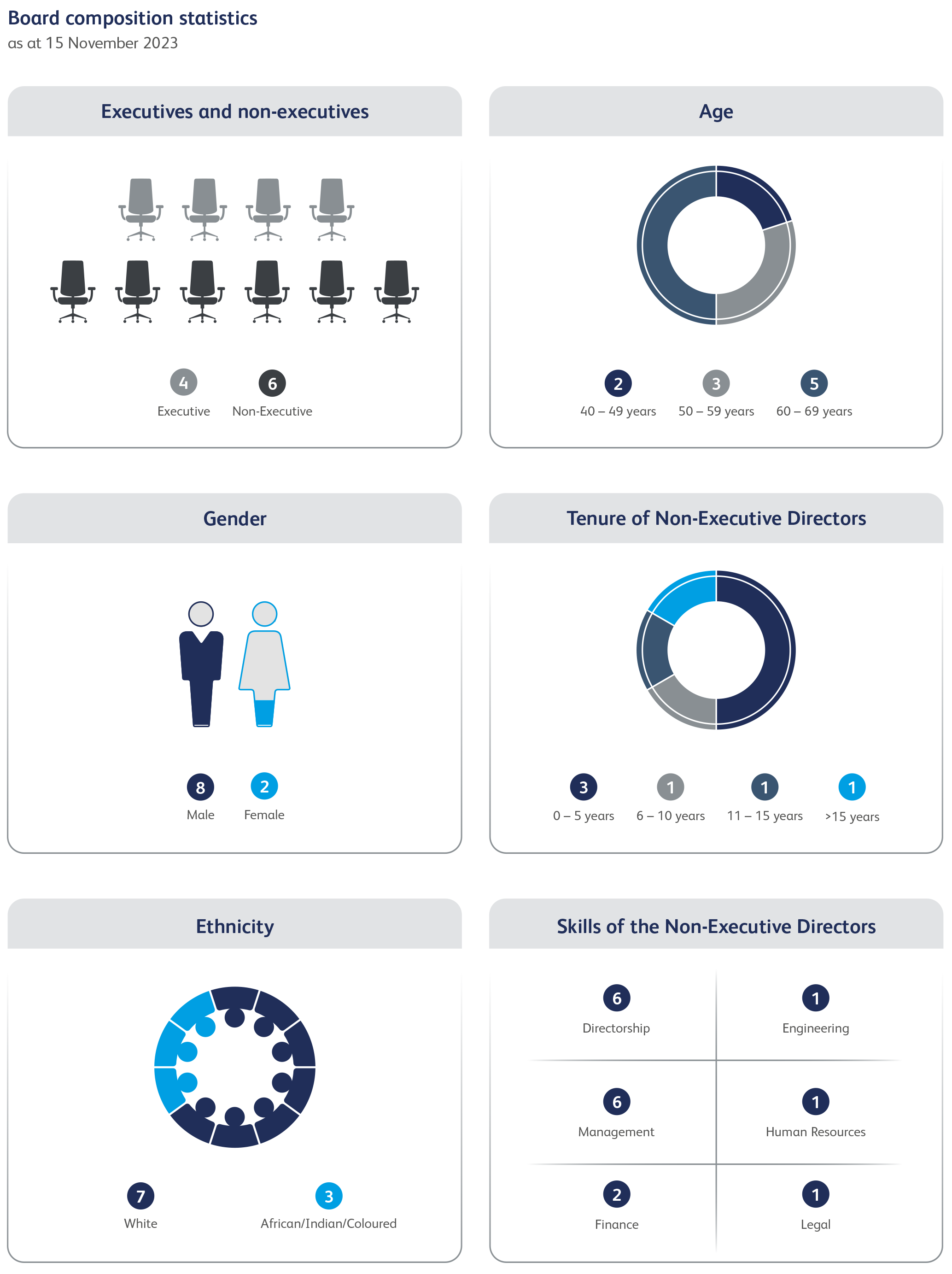

We have a unitary Board structure, presently comprising 10 directors, including six Independent Non-Executive Directors at year end. The roles of Chairman and CEO are separate and distinct. The composition of the Board ensures a balance of power and authority and negates individual dominance in decision-making processes. It also reduces the possibility of conflicts of interest and promotes objectivity. The Board is satisfied that its composition reflects the appropriate mix of knowledge, skills, experience, diversity and independence.

We believe that the Non-Executive Directors are of suitable calibre and number for their views to carry significant weight in the Board’s decisions. An Independent Non-Executive Chairman leads the Board. A schedule of beneficial interests of directors appears in Note 33 on page 190 of this Report. Astral’s MoI specifies that non-executive directors do not have a fixed term appointment.

Astral has three (30%) South African directors of previously disadvantaged backgrounds on the Board who are Independent Non-Executive Directors. The Board has set a target of 25% for race and gender representation in its membership.

Astral has a Board Broader Diversity Policy in place.

In November 2023, an evaluation of each of the Non-Executive Directors’ performance was conducted. The overall findings were presented to the Board and discussed. This evaluation supported the Board’s decision to endorse all retiring directors standing for re-election.

During the year, we assessed the independence of Dr Eloff and Mrs Shabangu, who have been directors for more than 10 years. After deliberation it was agreed that, considering the requirements for independence as contained in King IV™ and the Companies Act, they are still regarded by the Board as Independent Non-Executive Directors.

The Chairman’s major roles include:

• chairing all general meetings and Board meetings;

• assisting with the determination of the agenda for all general

meetings;

• ensuring that the Board receives accurate, timely and clear

information;

• keeping track of the contribution of individual directors;

• ensuring that all directors are involved in discussions and

decision-making; and

• taking a leading role in determining the composition and

structure of the Board; and ensuring effective communication

with shareholders and, where appropriate, the stakeholders.

The Lead Independent Director’s responsibilities are in line with

King IV™, namely:

• leading in the absence of the Chairman;

• serving as a sounding Board for the Chairman;

• acting as intermediary between the Chairman and other

members of the Board, if necessary;

• dealing with shareholders’ concerns where contact through the

normal channels has failed to resolve concerns, or where such

contact is inappropriate;

• strengthening independence on the Board if the Chairman is not

an independent non-executive member of the Board;

• chairing discussions and decision-making by the Board on

matters where the Chairman has a conflict of interest; and

• leading the performance appraisal of the Chairman.

No director is disqualified in terms of the criteria for independence as laid down by the JSE Listings Requirements or by King IV™.

The retirement age for an Executive Director will be 65 years and for a Non-Executive Director 73 years. In the case of the NonExecutive Director who turned 73 and was appointed by shareholders, such a director will be required to serve the full term until the next AGM.

The Chairman presides over meetings of the Board, guiding the integrity and effectiveness of the Board’s governance process. This includes ensuring that no individual dominates the discussion, that relevant discussion takes place, that the opinions of all directors relevant to the subject under discussion are solicited and freely expressed, and that Board discussions lead to appropriate decisions. The roles and functions of the Chairman have been formalised and there is a formally approved succession plan in place for the position of Chairman of the Board.

On a quarterly basis, Astral actively solicits from its directors their details regarding their external shareholdings and directorships, which potentially could create conflicts of interest while they serve as directors on the Board. The declarations received are closely scrutinised and are tabled at the beginning of each quarterly Board meeting. When applicable, directors are requested to table their interests in material contracts and, if necessary, are requested to recuse themselves from discussions in meetings.

Operational management is the responsibility of the CEO. His responsibilities include, amongst others, developing and recommending to the Board a long-term strategy and vision that will generate satisfactory stakeholder value, developing and recommending to the Board annual business plans and budgets that support the long-term strategy, and managing the affairs of the Group in accordance with its values and objectives, as well as the general policies and specific decisions of the Board. There is a formal succession plan in place for the CEO and he has a normal employment contract which is applicable to all employees which includes a notice period of two months by either party. The CEO is not a member of the Human Resources, Remuneration and Nominations Committee, the Audit and Risk Management Committee but attends by invitation. The CEO does not have any other professional commitments.

A complete list of Board members and their CVs appear on pages 14 to 16 of this Integrated Report. In terms of Astral’s MoI, new Non-Executive Directors appointed during the year, as well as one third of the existing Non-Executive Directors, have to retire on a rotational basis each year but may offer themselves for re-election.

Directors are required to undergo an induction programme including site visits to familiarise themselves with all aspects of Astral’s business. Briefing sessions take place when required to bring directors up to date with changes in laws and regulations pertaining to the Group.

The Board is accountable for the actions of management and has retained full and effective control of the organisation over the past year. The Board defines levels of materiality, reserving specific powers to itself, and delegates other matters to management. The Board is satisfied that the delegation of authority framework contributes to role clarity and effective exercise of authority.

The Board meets at least quarterly to review strategy, planning, operational performance risks, B-BBEE compliance, acquisitions, disposals, shareholder communications and other material aspects pertaining to the achievement of the Group’s objectives.

The Board periodically reviews the mix of skills and experience available within the Board. Procedures for appointment to the Board are formal and transparent and are vested in the Board and include detailed screening of nominees to ensure that they meet the eligibility requirements as laid down in the Companies Act and the JSE Listings Requirements.

The Board conducts assessments of each director annually based

on several factors including expertise, objectivity, judgement,

understanding the Group’s business, willingness to devote the time

needed to prepare for and participate in committee deliberations.

The performance evaluations were completed and reviewed by the

Chairman and found to be generally satisfactory. The performance

evaluation of the Chairman is reviewed by the lead independent

non-executive director. If required, the Chairman meets with

individual Board members to discuss their performance. The

following assessments were completed during the year:

• performance evaluation of the Audit and Risk Management

Committee;

• performance evaluation of the Human Resources, Remuneration and Nominations Committee;

• performance evaluation of the Social and Ethics Committee;

• performance evaluation of the Board;

• performance evaluation of the Chairman;

• performance evaluation of the CEO; and

• performance evaluation of the Group Company Secretary.

The Board is satisfied that the evaluation process, although not externally facilitated, does add value and is effective in improving the performance of the Board.

Strategic planning meetings take place at least every second year and progress on strategic objectives is reviewed at every Board meeting.

Directors have access to the advice of the Group Company Secretary and may seek independent and professional advice about affairs of the Group at the Company’s expense.

The Board confirms that it is satisfied that it fulfilled its responsibilities in accordance with its Mandate and Terms of Reference for the year under review.

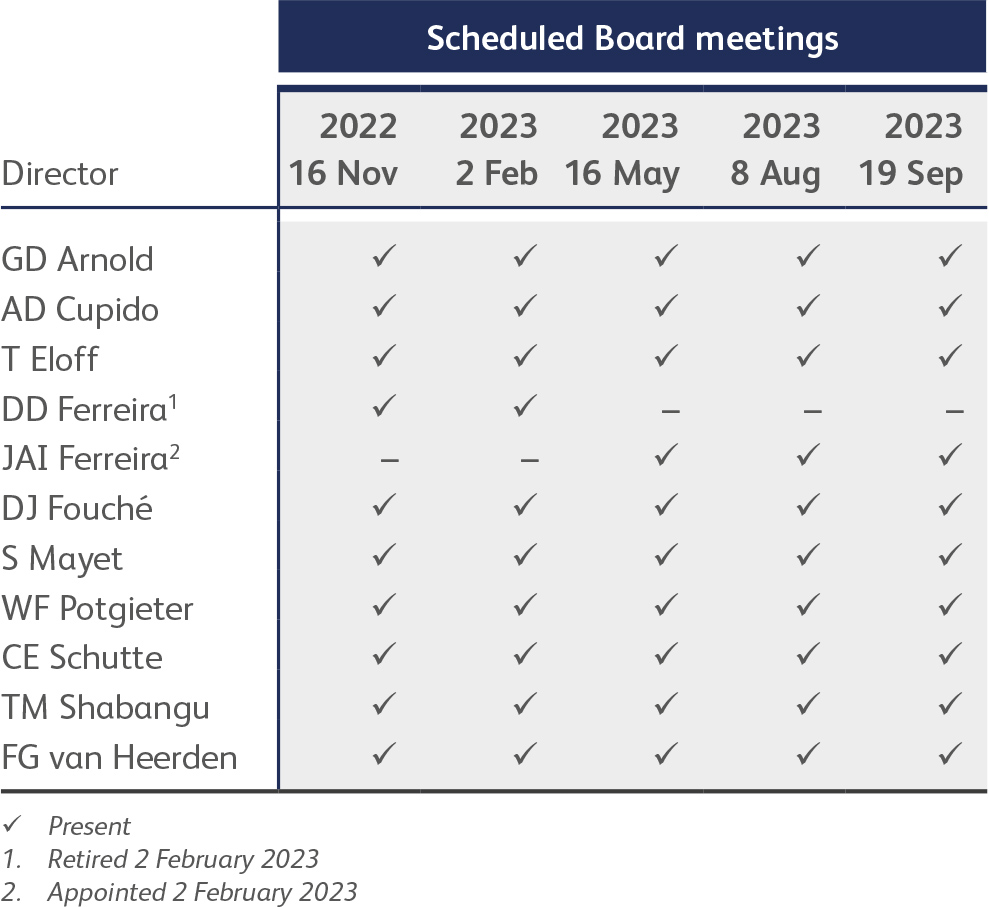

Four Board meetings were held during the past year. Additional

Board meetings may be convened when necessary.

Attendance at meetings was as follows:

The Board is supported by the Audit and Risk Management, the Human Resources, the Remuneration and Nominations, the Social and Ethics as well as the ESG Committees to carry out its oversight role of ensuring that implementation of the Group’s strategy is managed in a manner that is consistent with the values of the Group.

The Board believes that the Group has applied all relevant governance principles and is compliant with all significant Listings Requirements. The Group has not breached any regulatory requirements and has complied with all its statutory obligations.

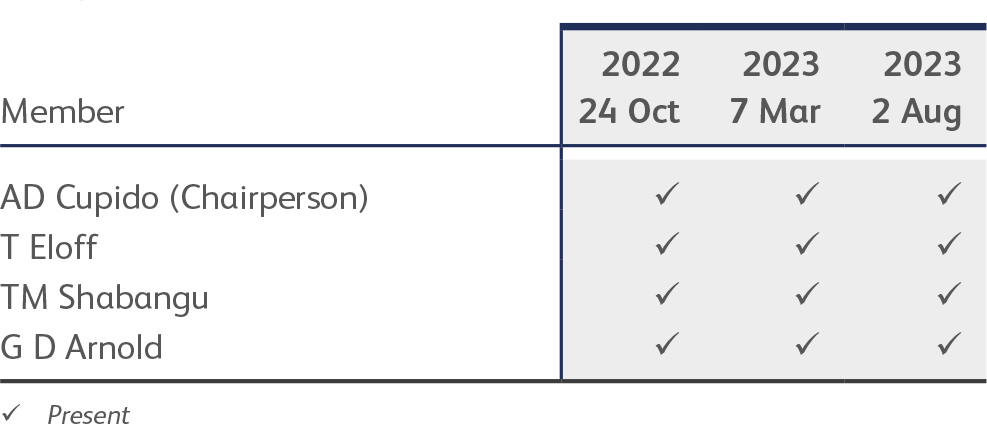

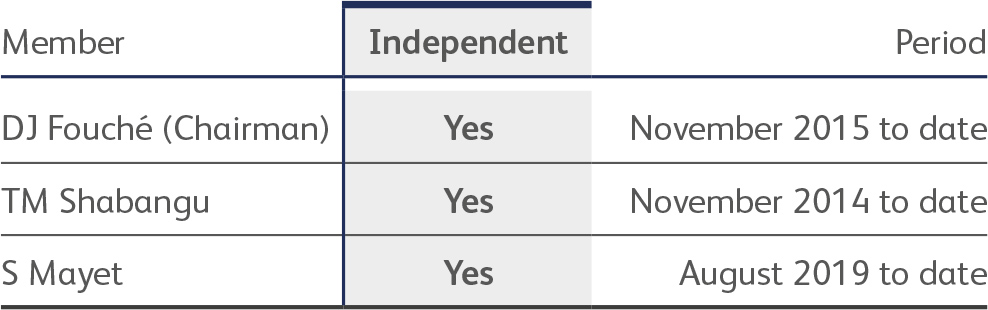

The committee met three times during the year. Attendance at the meetings was as follows:

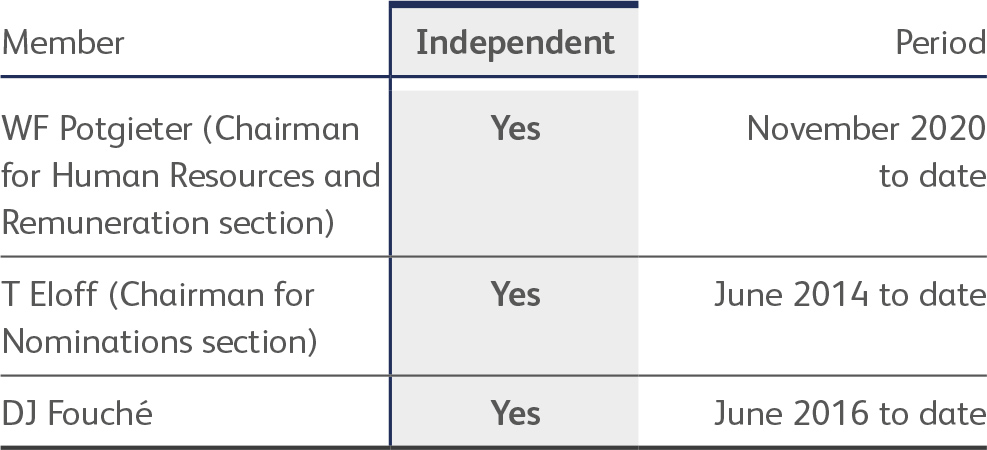

The committee met five times during the year. Attendance at meetings was as follows:

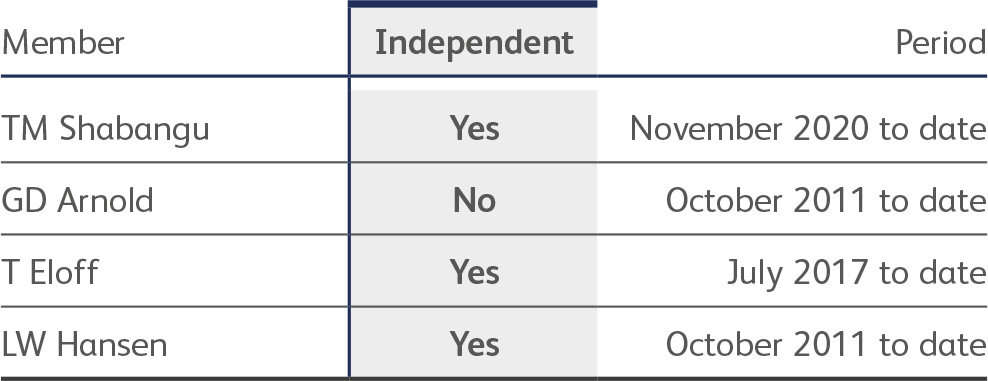

The committee met three times during the year. Attendance at meetings was as follows:

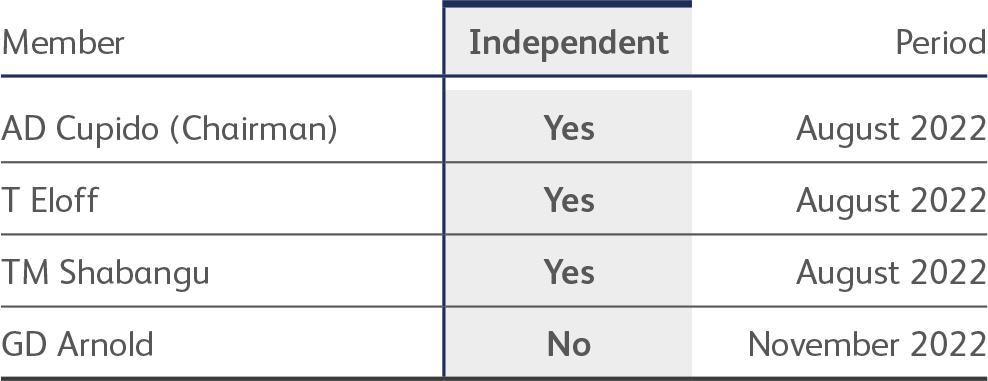

The committee met three times during the year. Attendance at meetings was as follows:

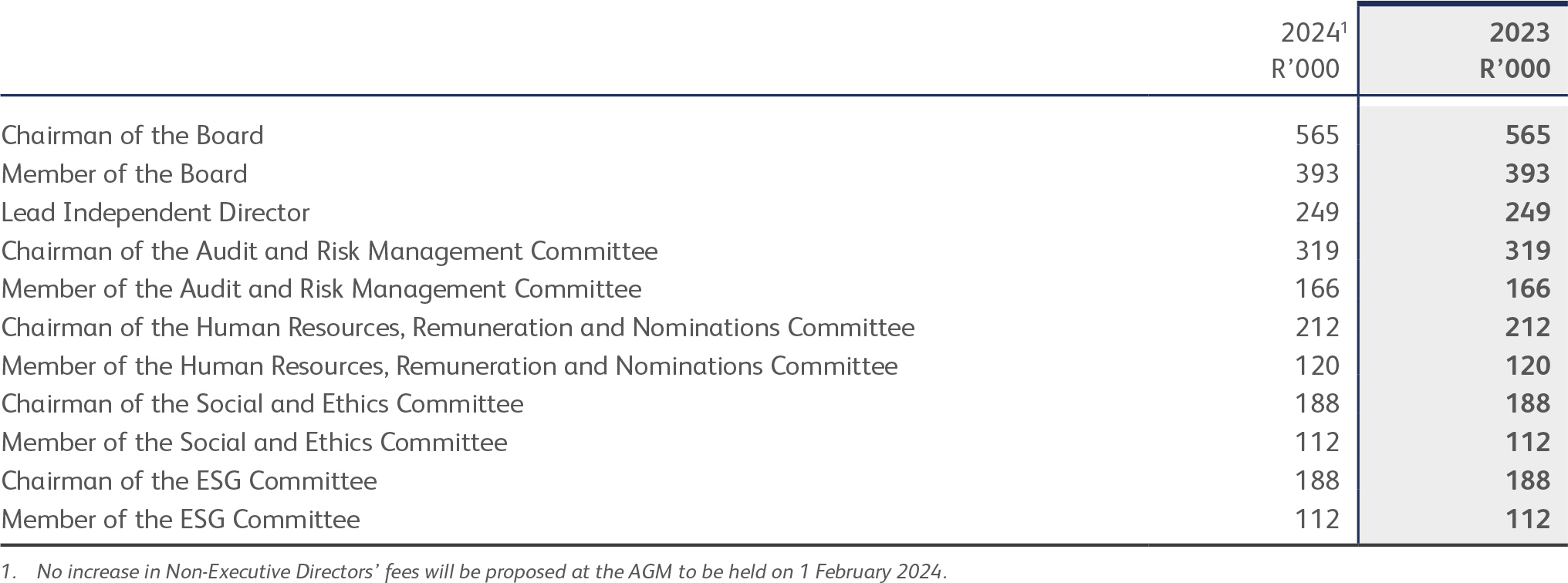

The non-executive directors received the following fees during the year:

To enable the Board to properly discharge its responsibilities and

duties, certain responsibilities have been delegated to Board

committees. All Board committees are chaired by an Independent

Non-Executive Director. Particulars of the composition of the Board

and committees appear on pages 14 to 16 of this Integrated

Report. Board committee Mandates and Terms of Reference are

reviewed on an annual basis to ensure that the committees’ duties

and responsibilities are aligned with the requirements of corporate

governance and keep abreast of developments in this field. Copies

of Board committee Mandates and Terms of Reference are available

on Astral’s website, www.astralfoods.com.

As the Audit and Risk Management Committee has become a statutory committee in terms of the Companies Act, shareholders are required to elect the members of this committee at the next AGM.

Shareholders will also be required to elect the members of the Social and Ethics Committee for the forthcoming financial year at the next AGM.

The Board committees are as follows:

The Audit and Risk Management Committee comprises three members, all of whom are Independent Non-Executive Directors, and meets at least three times a year with management, internal and external auditors as well as the Group’s risk managers.

The opportunity is created at each meeting for discussion with the external and internal auditors without the presence of management. The members of the committee are knowledgeable about the affairs of the Group and have extensive expertise in finance, accounting, legal and risk management practices.

The Audit and Risk Management Committee fulfils the

responsibilities as set out in the Audit and Risk Management

Committee Mandate and Terms of Reference, which include:

• overseeing the internal and external audit functions;

• assisting the Board in the discharge of its duties relating to the

safeguarding of assets and operation of adequate systems and

internal controls;

• ensuring the preparation of accurate financial reporting in

compliance with all applicable legal requirements, corporate

governance and accounting standards;

• providing support to the Board on evaluating the risk profile and

risk management of the Group; and

• providing support to the Board on IT governance and risks.

A copy of the Mandate and Terms of Reference of the committee is

available on Astral’s website, www.astralfoods.com.

Both the Director: Risk Management and the external auditor have

unfettered access to the CEO, the Chairman of the Board and the

Audit and Risk Management Committee.

The committee reviews and confirms the following additional

responsibilities required by King IV™ and the JSE Listings

Requirements:

• the independence of the external audit function;

• the competence of the CFO and the finance function of the

Group; and

• the Integrated Report.

Divisional Audit Committee meetings are scheduled twice a year at every business unit. These meetings are chaired by the CFO, attended by the CEO, internal audit, external audit, the Managing Director and Divisional Finance Executive, and the business unit COO and Finance Executive.

Astral is committed to the following risk management action plan:

• identifying the risks to which the Group is exposed;

• identifying the most effective ways of eliminating or mitigating

risk exposures as far as is reasonably practical;

• insuring against catastrophic incidents and other losses beyond

our self insurance capacity; and

• minimising in the long term, the total cost of risk.

Astral applies an enterprise-wide risk management approach, involving all levels of management, with assistance from outside consultants for assessing insurable risks.

Members of the Audit and Risk Management Committee are:

Astral has established an independent, objective and effective

Internal Audit Department governed by a charter approved by the

Board. The internal audit function reports to the CEO and has

unfettered access to the Chairman of the Board and the Chairman

of the Audit and Risk Management Committee.

The role of internal audit is to review compliance with internal

controls, systems and procedures. The Board is satisfied that the

internal controls are adequate to safeguard the assets, prevent and

detect errors and fraud, ensure the accuracy and completeness of

accounting records and the preparation of reliable financial

statements.

The Internal Audit Department is staffed by qualified and

experienced internal auditors. The annual internal audit programme

is approved by the committee and all significant findings, together

with steps taken to rectify lapses in internal control, are reported at

every committee meeting.

The independence of the internal audit function is reviewed by the Audit and Risk Management Committee to satisfy itself of the independence of the internal audit function. The appointment and removal of the head of internal audit is a matter for the Audit and Risk Management Committee in consultation with management.

The Board has delegated responsibility for IT to the Audit and Risk Management Committee but retains overall accountability.

An IT Charter, aligned to King IV™, has been implemented. The IT strategy is reviewed by the Audit and Risk Management Committee and by the Board. The IT Charter can be viewed on Astral’s website, www.astralfoods.com.

Management has the responsibility for the management of IT and

the governance framework which includes:

• IT Steering Committee to monitor and manage IT governance;

• IT policies and procedures to regulate the management of all IT

functions;

• relevant standards and processes that are subject to audits,

reviews and benchmarks; and

• policies and procedures to govern the active directory and

exchange which has been outsourced.

All IT acquisitions fall within the same capital approval processes as other capital expenditure projects and would thus, based on value, be submitted to the Board for approval.

A formalised disaster recovery programme is in place to ensure the minimum disruption in the event of disaster.

• takes cognisance of all factors and risks that may impact the

integrity of the Integrated Report including matters that may

predispose management to present a misleading picture,

significant judgements and reporting decisions made, monitoring

or enforcement actions by a regulatory body and any evidence

that brings into question previously published information,

forward-looking statements or information;

• reviews for reliability, the disclosure of sustainability in the

Integrated Report;

• recommends to the Board whether or not to engage an external

assurance provider on material sustainability issues;

• considers whether the external auditor should perform assurance

procedures on interim results or be engaged for any non-audit

assignments.

The committee recommended to the Board to continue not to publish a summarised Integrated Report or engage an external assurance provider to confirm material elements of the sustainability part of the Integrated Report. This decision was based on the fact that sustainability reporting formed part of the budget process and is reported on by business units and approved by the executive directors. This approach will be reviewed every year. Astral has appointed a full-time Sustainability Manager who is responsible for sustainability within the Group.

Further information regarding the activities of the committee is available in the Audit and Risk Management Report on pages 137a to 140 of this Integrated Report.

The primary duty of the committee in terms of the nomination process, is to ensure that the procedures for appointments to the Board are formal and transparent, by making recommendations to the Board on all new Board appointments and reviewing succession planning for directors. The committee also has to evaluate all candidates for the position of director on the basis of skill and experience. Thorough background checks are conducted.

WF Potgieter chairs all sections of meetings of the committee dealing with Human Resources and Remuneration. However, sections dealing with matters related to Nominations are chaired by T Eloff, the Chairman of the Board. The committee’s Mandate and Terms of Reference is available on Astral’s website, www.astralfoods.com.

Members of the Human Resources, Remuneration and Nominations Committee are:

The committee is constituted as a Board committee and assists the

Board in discharging its responsibilities for the development of the

Group’s general policy on executive and senior management

remuneration and to determine specific remuneration packages for

executive directors of the Group, including but not limited to basic

salary, benefits in kind, bonuses, performance-based incentives,

retention incentives, share incentives, pensions and other benefits.

The committee determines criteria necessary to measure the

performance of executive directors in discharging their functions

and responsibilities.

Further information regarding the activities of the committee is

available in the Human Resources, Remuneration and Nominations

Committee Report on pages 83 to 112 of this Integrated

Report.

The Social and Ethics Committee consists of four members. A formal mandate and terms of reference has been approved by the Board. The Chairperson of the committee is present at the AGM and will be available to report to shareholders on the matters within its mandate. A copy of the committee’s mandate and terms of reference is available on our website, www.astralfoods.com.

Members of the Social and Ethics Committee are:

The main functions of the committee are:

Monitor the Group’s activities, having regard to any relevant

legislation, other legal requirements and codes of best practice,

including but not limited to:

• social and economic development;

• responsible corporate citizenship;

• environment, health and public safety;

• consumer relationships;

• labour and employment;

• drawing matters within its mandate to the attention of the

Board; and

• reporting annually to the shareholders at the Company’s AGM

on matters within its mandate.

To support and respect for the protection of internationally proclaimed human rights.

•LabourTo uphold the freedom of association and the effective recognition of the right to collective bargaining, the elimination of all forms of forced and compulsory labour, the effective abolition of child labour and the elimination of discrimination in respect of employment and occupation.

•EnvironmentTo support a precautionary approach to environmental challenges, undertake initiatives to promote greater environmental responsibility and encourage the development and diffusion of environmentally friendly technologies.

•EnvironmentTo support a precautionary approach to environmental challenges, undertake initiatives to promote greater environmental responsibility and encourage the development and diffusion of environmentally friendly technologies.

•Anti-corruptionTo work against corruption in all its forms, including extortion and bribery.

•Social and ethical awarenessTo conduct ethical climate surveys.

•Community upliftment and donationsTo develop guidelines for charities and sponsorships.

•Consumer developmentTo ensure compliance with the Consumer Protection Act.

•Environment and sustainability reportingTo investigate areas which do not fall within the scope of responsibilities of the Audit and Risk Management Committee.

For more information regarding the activities of the committee, refer to the Social and Ethics Report on pages 64 to 67 of this Integrated Report.

The purpose of this committee is to support the Company’s ongoing commitment to sustainability, with specific emphasis on environmental stewardship, corporate governance and accountable social engagement.

Members of the ESG Committee are:

Astral maintains a Code of Ethics, which requires all employees,

managers and directors to comply with the letter and spirit of the

Code of Ethics by observing the highest ethical standards and

ensuring that all business practices are conducted ethically.

A policy provides guidelines as to what constitutes fraud, theft, corruption, or associated internal irregularities, to outline our response to these and to detail the procedures to be followed in order to report such incidents that are suspected or discovered.

Astral has a “zero tolerance” approach towards fraud and corruption and protect employees who raise concerns relating to fraud and corruption from victimisation.

Astral continues to use the services of Deloitte to provide an independent “Tip-offs anonymous” hotline. All incidents reported are investigated and appropriate action taken in terms of the relevant policies and disciplinary procedures.

Copies of Astral’s Ethics Policy are displayed on all notice boards, laminated abridged copies are handed to every employee and the COO of each business unit is tasked to act as champion for his/her business unit to ensure that the Ethics Policy is understood and adhered to by all employees. The Ethics Policy forms a permanent part of every management agenda and external suppliers are required to adhere to the Ethics Policy. Any non-adherence is reported to business unit management and in turn reported to the CEO and Group COO and ultimately to the Board.

The Code of Ethics deals with:

• complying with all laws, regulations and codes;

• culture, ethics and values;

• dealing openly and honestly with customers, suppliers and other

stakeholders;

• respecting and protecting privacy and confidentiality;

• respecting human rights and dignity of employees;

• social responsibility;

• guidelines in respect of receiving and giving gifts and

entertainment;

• prohibiting the acceptance of bribes, directly or indirectly;

• prohibiting the payment or offering of bribes;

• integrity of financial information;

• protection of confidential information;

• protection and use of Group property;

• conflict of interest; and

• action on contravention of the Code of Ethics.

In terms of accountability, all employees are required to:

• commit to individual conduct in accordance with the Code of

Ethics;

• observe both the spirit and the letter of the law in their dealings

on the Group’s behalf;

• recognise the Group’s responsibility to its shareholders,

customers, employees, suppliers and to society;

• conduct themselves as responsible members of society, giving

due regard to health, safety and environmental concerns, and

human rights, in the operation of the Group’s business; and

• report any suspected breach of the law or the Code of Ethics to

the Internal Audit Department or the Board who will protect

those who report violations in good faith.

The Board accepts overall responsibility for the adherence to the Code of Ethics and has no reason to believe that there has been any material non-adherence to the Code of Ethics during the year under review. The Code of Ethics is reviewed on a regular basis by the Social and Ethics Committee.

A copy of the Code of Ethics is available on our website, www.astralfoods.com.

Directors and employees are prohibited from dealing in Astral

shares during price sensitive periods. Closed periods extend from 31

March and 30 September, being the commencement of the interim

and year-end reporting dates, up to the date of announcement of

interim and year-end results and include any other period during

which the Company is trading under a cautionary announcement.

All directors are required to obtain written permission from the

Chairman before dealing in any Astral shares in order to protect

them against possible and unintentional contravention of the

insider trading laws and JSE regulations.

We have implemented an Information Policy that deals with prohibited periods for dealing in Astral shares, the determination of price sensitive information, periodic financial disclosure and affected directors’ dealings in Astral shares. The Information Policy is available on Astral’s website, www.astralfoods.com.

Participants in Astral’s share incentive schemes are subject to the rules of the schemes and the provisions of the Listings Requirements.

Astral has comprehensive management reporting disciplines, which

include the preparation of strategic plans and annual budgets by

all operations. Group strategic plans and budgets are considered

and approved by the Board. Results and the financial status of the

operations are reported monthly and compared with approved

budgets and results of the previous year. Working capital

requirements and borrowing levels are monitored on an on-going

basis and corrective or remedial action taken as appropriate.

The Group Company Secretary is suitably qualified and experienced

and plays an important role in ensuring that the Board procedures

are followed correctly and are regularly reviewed. The Group

Company Secretary is responsible for the duties set out in Section

88 of the Companies Act and is appropriately empowered by the

Board to fulfil these duties.

The Board assesses the qualification, competence and expertise of the Group Company Secretary and confirms her suitability in terms of the Listings Requirements on an annual basis. For further information on the Group Company Secretary, please refer to Corporate Services on page 51 of the Integrated Report.

The Group Company Secretary is not a director of any of the

Group’s operations and accordingly maintains an arm’s length

relationship with the Board and its directors. In order to confirm the

Group Company Secretary’s arm’s length relationship with the

Board, the following factors are taken into consideration:

• the Group Company Secretary is independent from management;

• the Board empowers the Group Company Secretary to act as

gatekeeper of good corporate governance;

• there are no special ties between the Group Company Secretary

and any of the directors;

• the Group Company Secretary is not party to any major

contractual relationship which may affect his/her independence;

and

• there are no matters affecting the Group Company Secretary’s

ability to adequately and effectively perform his/her company

secretarial duties.

The annual assessment concluded that the Group Company Secretary, when engaging with the Board, acted professionally, independently from the Board and interacted on an equal footing with the Board. The relationship between the Group Company Secretary and the Board was without influence or undue pressure.

Astral does not make any contributions to political parties.

In accordance with the provisions of the Protected Disclosures Act

No. 26 of 2000, management has ensured that no employee who

has made a protected disclosure shall be subject to any occupational

detriment and shall be afforded anonymity without fear of

consequential victimisation. Refer to the “Tip-Offs Anonymous”

section on page 87 of the Integrated Report.

The Board believes that access to professional corporate governance

services are available and is effective.

The Board operates according to an approved corporate governance

framework that provides for prudent management and oversight of

the business and adequately protects the interests of all

shareholders.

The members of the Executive Management and the heads of support functions are responsible for adherence to and implementation of the framework in their business and operational areas.

The following documents are available on www.astralfoods.com: